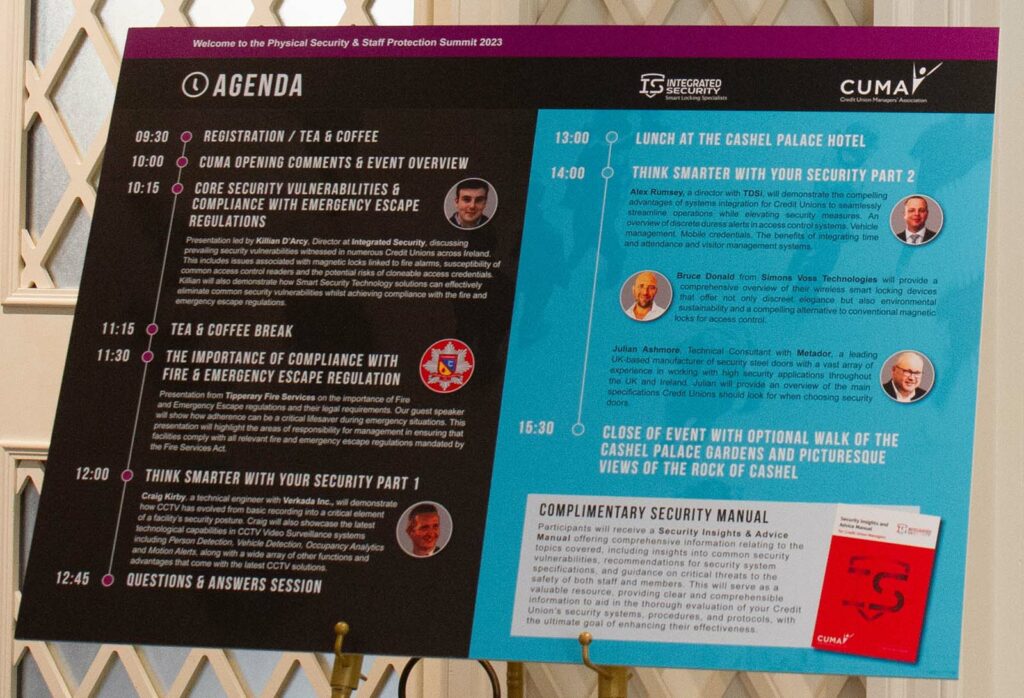

We were thrilled to host the Physical Security & Staff Protection Summit in association with CUMA – Credit Union Managers Association on November 28th at the Cashel Palace Hotel. This summit saw delegates from Credit Unions and Garda Crime Prevention Officers from all corners of the country attend.

Common Physical Security Vulnerabilities

The first speaker was Killian D’Arcy, a director with Integrated Security uncovering the most prevalent security vulnerabilities that Credit Unions face. These vulnerabilities ranged from the reliance on Mechanical Key locks, the Low Security achieved by Magnetic locks used for Access Control, Easy to manipulate Access Control readers, Security Threats posed by readily available hacking devices like Flipper Zero and Building entry points that rely on Domestic grade doors, standard or laminate glass and security shutters.

After highlighting the common security vulnerabilities Killian demonstrated clever ways to remove and mitigate the risks of these vulnerabilities and highlighted the importance of designing in security into Credit Union Facilities. As part of the Presentation, clear emphasis was put on the fact that by harnessing the Power of Smart Security Technology combined with High Security Auto Locking Locks, Credit unions can achieve high levels of Physical Security and full compliance with the mandatory Fire and Emergency Escape Regulations.

Emergency Escape Regulations

Next up we had Martin Moore, a Fire Officer with Tipperary Fire Services who gave an overview of the obligations Credit Union Managers have to ensure their building is compliant with the mandatory Fire and Emergency Escape regulations. Martin highlighted that ignorance of management’s obligations to ensure their facilities are safe and compliant is not an acceptable defense and that non compliance with these regulations is a severely punishable crime with a punishment of up to 3 years in prison.

Martin highlighted the importance of keeping the escape routes in the facility clear and free from obstructions, the importance that emergency escape doors are fitted with certified Emergency escape compliant locking systems and that all reasonable measures have been taken to protect the health, safety and welfare of the occupants of the building.

Cloud-based CCTV

Rob Yeates and Craig Kirby from Verkada Inc gave a comprehensive overview of the advantages of Cloud Based CCTV, Air Quality, Intercom and Visitor Management Systems. Verkada’s cloud platform is at the core of a number of our solutions. This presentation highlighted how features like person detection, vehicle detection, occupancy analytics and motion detection along with Person of Interest notifications can redefine user friendliness and performance of CCTV Systems.

The presentation also highlighted the advantages of Cloud based CCTV Solutions over traditional on premises CCTV Systems for reasons such as having no one single point of failure, enhance cyber security and GDPR compliance along with the automatic firmware updates ensuring your CCTV Devices are always up to date and using the latest encryption and Cyber Security Standards.

Crime Prevention

Sergeant Tom O’Dwyer, Crime Prevention Officer for the Tipperary region with An Garda Siochana gave a quick overview about the Crime Prevention Unit in An Garda Siochana and highlighted how Credit Unions should engage the advice from the Crime Prevention Unit along with the advice of specialist security service providers to the Credit Union sector.

Integrated Access Control

Gwen Curran and Alex Rumsey from TDSi UK gave an overview of the importance of choosing an Enterprise Level Integrated Access Control System, they outlined the many advantages that can be achieved through systems integration such as integrating time and attendance, visitor management, Mobile Keys and Vehicle Management Systems into one overall Smart Security System.

They also outlined the importance of using OSDP communication protocol between the Access Control reader and the main access control system. Alex also gave an overview of new features coming on stream in Q1 2024 such as the Discrete Duress Feature that was created specifically for the Credit Union market.

Smart Wireless Locking

Bruce Donald from Simons Voss Technologies provide a comprehensive overview on the Advantages of Smart Wireless Locking Devices. Bruce demonstrated how Wireless Smart Handles allow for a more streamlined installation as there are no cables to be installed and how these devices are fully compliant with Fire and Emergency Escape regulation whilst still providing high levels of physical security.

Bruce provided a compelling case on how Smart Wireless locking devices from Simons Voss are one of the most sustainable Locking Systems on the market and he showed how Credit Unions can save up to €500 per door per year by using Smart Wireless Locking Devices from Simons Voss over conventional heavy duty magnetic locks.

Steel Doors

Our final speaker for the day was Julian Ashmore from Metador, Julian provided significant insights into the varying degrees of security provided by steal doors, highlighting that just because it is a steel door doesn’t mean it is secure. Julian also highlighted the prevalence of budget range steel doors on the market and that Credit Unions should avoid choosing security doors with self assessed security ratings such as PAS24. Julian showcased the importance of choosing proper independently tested and certified security rated doors with certifications such as LPS1175 SR3 and SR4 at a minimum for the Credit Union sector. Julian also highlighted how Security rated doors don’t have to be ugly and unappealing, that they can manufacture very elegant and aesthetically appealing doors with a huge variety of finishes available.

Security Booklet

Each delegate also received a complimentary copy of our Security Insights booklet which provides comprehensive and detailed security advice tailored specifically for Credit Unions. This Security Advice manual is available in a digital copy upon request to Credit Union officials or a physical copy can also be sent to Credit Union officials. This booklet is not available to the general public and due to the sensitive nature of the content this booklet can only be emailed to an official Credit Union email address or posted to an official Credit Union Branch.

About Integrated Security

At Integrated Security we are a specialist Smart Security Technology provider to Credit Unions across Ireland. Should you wish for our assistance to evaluate your security or to prepare a Security System design proposal specifically for your Credit Union please feel free to contact us on info@integratedsecurity.ie or call 052 6128090

Killian D’Arcy

Director & Electronic Locking System Engineer